prince william county real estate tax rate

Prince William County - Home Page. The countys current real estate tax rate is 1115.

Job Opportunities Prince William County

Find All The Record Information You Need Here.

. FY 2021-2022 Real Estate Tax Rates. A House location survey shows the boundary of the parcelland and. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

Based on these rates the average residential real estate tax bill increase is 248 233 from the real estate tax and 15 from the fire levy. Report a Vehicle SoldMovedDisposed. Tax and fee hikes on real-estate property data centers vehicles boats and trailers could be on the way to provide additional funding for Prince William County schools and other needs after the Board of Supervisors voted Tuesday to advertise a package of higher tax rates ahead of public hearings on the proposed 2021 budget.

If you are searching by gpin please. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. Zillow has 399 homes for sale in Prince William County VA.

2 days agoPrince William County residents will face higher property taxes over the next 12 months with the average homeowner paying 172 more in Real Estate taxes. The Board of County Supervisors reviewed. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. The property tax calculation in Prince William County is generally based on market value.

This results in the average residential real estate. The county is proposing a decrease in the residential real estate tax rate from 1115 per 100 of assessed value to 105. All rates are per 100 of assessed value.

The Board reduced the real estate tax rate from 1115 to 103 per 100 of assessed value while also reducing the fire levy rate from 008 to 0075 per 100 of assessed value. 9 hours agoPrince William County has approved its budget for the new fiscal year and residents will be paying higher taxes. Although the rate is dropping rising property values will result in an.

Property Taxes Mortgage 346595000. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Enter jurisdiction code 1036.

Last week county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103. The real estate tax is paid in two annual installments as shown on the. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office.

The fire levy rate is also reduced from the current rate of 008 per 100 of assessed value to 0075. Unsure Of The Value Of Your Property. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return. For more information please visit Prince William Countys Department of Real Estate Assessments or look up this propertys current valuation. City of Falls Church.

Press 1 to pay Personal Property Tax. Report a Change of Address. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes.

For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. Prince William County VA currently has 464 tax liens available as of April 16. County officials are proposing imposing a 4 meals tax to help fund Prince William Countys upcoming fiscal year 2023 budget.

The tax rate is expressed in dollars per one hundred dollars of assessed value. Enter the Account Number listed on the billing. The countys current real estate tax rate is 1115.

The new tax is expected to generate a total of 245 million in revenue next year with 14 million going to the Prince William County school division and 105 million to the county government according to county. Report changes for individual accounts. Prince Williams board of supervisors is moving toward adopting a budget for fiscal year 2021 that keeps the countys real estate property tax rate flat while increasing the data center and vehicle license taxes to fund some staff pay raises and launch new programs aimed at helping residents cope with the economic fallout of the COVID-19 pandemic.

Real Estate Property Tax Rates. Ad Find County Online Property Taxes Info From 2021. The original proposal dropped the rate to 105.

300000 100 x 12075 362250. 0265 Fairfax County Tax. Report a New Vehicle.

The biggest sticking point was the approved real estate tax rate of 103 per. Dial 1-888-2PAY TAX 1-888-272-9829. You will need to create an account or login.

The Prince William Board of County Supervisors is poised to reduce the countys real estate property tax rate for the first time since 2016 while increasing the countys data center tax rate and implementing a new cigarette tax to fund. Prince William County accepts advance payments from individuals and businesses. Have pen and paper at hand.

The fire levy rate is also reduced from the current rate of 008 per 100 of assessed. Press 2 to pay Real Estate Tax.

Prince William County Housing First Time Homebuyer Program Youtube

How To Dispose Of Tech Gadgets Seasonal Waste In Prince William County Headlines Insidenova Com High School Fun Prince William County School Board

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

National Park Service Prince William Forest Park Sign Virginia Travel National Park Service Forest Park

Prince William County Va News Wtop News

New 800 Acre Data Center Campus Proposed In Prince William County Virginia Dcd

Best Of Prince William 2022 Voting Begins Headlines Insidenova Com

How Healthy Is Prince William County Virginia Us News Healthiest Communities

2022 Best Places To Live In Prince William County Va Niche

Animal Advocates Call For A New Prince William Animal Shelter Headlines Insidenova Com

Prince William County Real Estate Prince William County Va Homes For Sale Zillow

Acting County Executive Proposes The Fiscal Year 2023 Budget Prince William Living

Prince William County Va Real Estate Market Realtor Com

Where Residents Pay More In Taxes In Northern Va Wtop News

The Prince William County Virginia Local Sales Tax Rate Is A Minimum Of 4 3

Best Places To Live In Prince William County Virginia

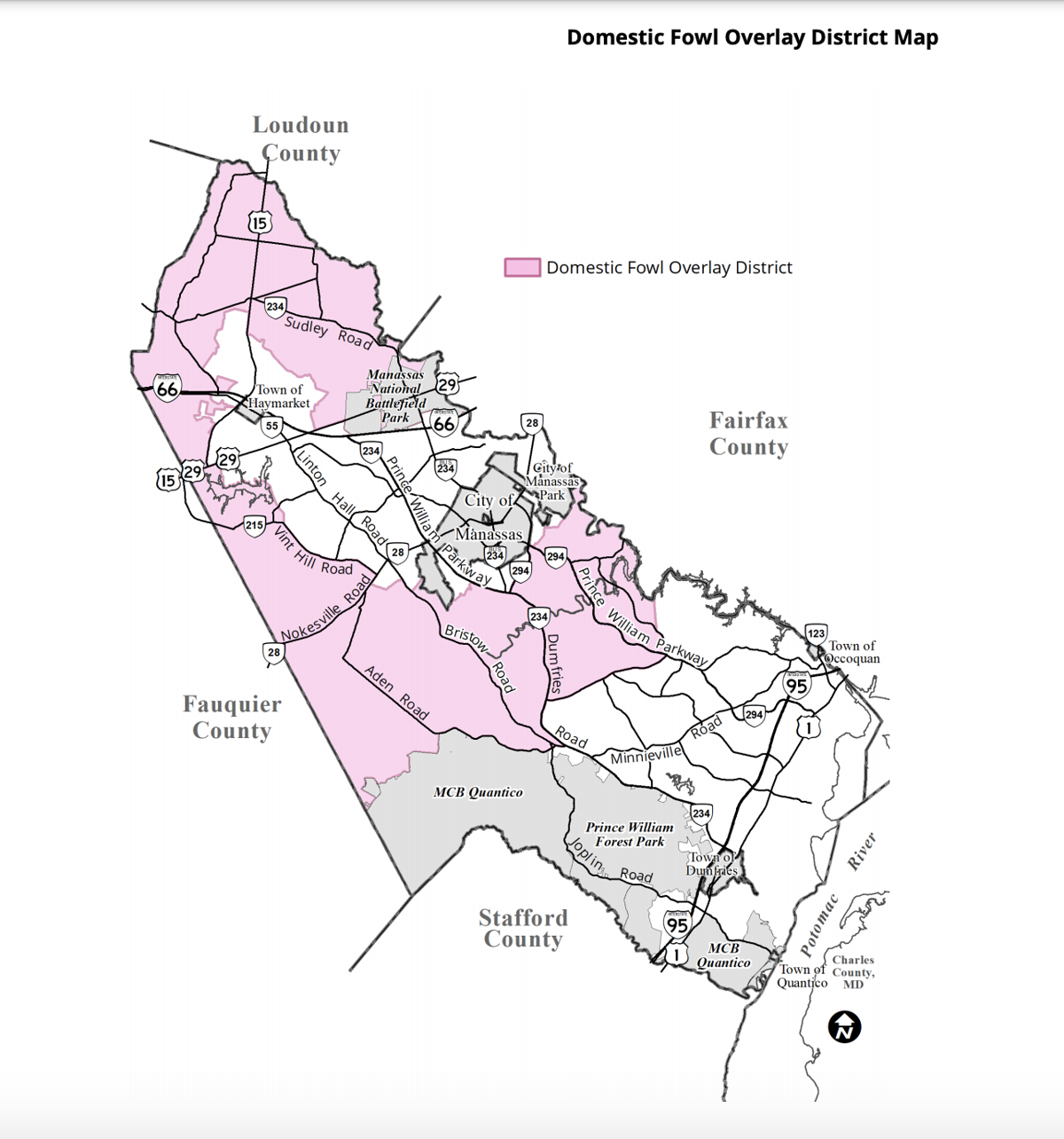

More Prince William Residents Can Have Cattle And Chicken Under New County Rules News Princewilliamtimes Com